恆生指數期權攻略 第 一 篇

期權認識

先簡單為大家介紹一下甚麼是期權, 為何要認識?

期權:

期 - 指一個期限, 一段時間之內

權 - 是一個權利. 行使權利.

例如:

甲乙雙方簽訂一個合約, 甲同意收取乙方 50元, 讓乙在 30 天內的任何一天,

用 10 元一個杯的價格, 買入 (或賣出) 1,000 個杯.

所以乙就有這個權利在30 天內的任何一天, 去行使這個權利.

而甲則要在乙行使權利時, 必需履行合約.

********

是不是產生了一個問題, 這種合約對雙方有甚麼好處 ?

在甲方立埸, 市埸的杯是 10 元一個, 甲收取乙 50 元費用,

不管乙方到時要多少杯, 在市場買給他就是了.

對於甲來說, 平白就賺取了 50 元, 何樂而不為 ? 是不是很精明 ?

這 50 元 差不多是保險金形式.

但對於乙來說, 則不是這樣看.

乙覺得在這 30 天內, 杯子價格會上漲(或下跌), 但又不太肯定.

乙用 50 元當作保險金, 萬一杯子價格真的波動, 那麼仍何用預算中的合約所訂價 10 元去行使購買 (或賣).

至於乙為何又這麼笨, 不直接在市場先買入(或賣出) 1,000 個杯, 卻要多付 50 元再之後才買 (或賣)呢 ?

原因有很多, 乙可能暫時沒有那麼多資金, 要在 30 天內才有.

不想在市場沽貨, 仍看好後市.

而當中更複雜的內情是: 原來乙收取丙 100 元一個合約, 所以他用 50 元把這個合約風險轉給了甲.

他可是穩賺了 50 元.

而乙卻不是最精明, 因為丙是以 500 元一個合約賣給丁的. 所以丙的穩賺是 400 元一個合約.

*********

上面的例子又有兩個問題了, 甲由精明變成最笨, 收那 50 元卻要冒大風險.

而丁卻為甚麼願付那麼高價去訂這合約 ? 直接去買入 (或賣出) 那些杯不是更好嗎 ?

卻原來還大有文章, 原來甲是杯子的大生產商, 控制著杯子的市場價格. (假設來的)

所以在他跟乙簽訂合約後的 30天, 把杯子的價格都控制在 10 元以下 (或以上)

變成了乙在 30 天內, 直接在市場買賣比行使權利更好, 於是乙肯定放棄行使.

而甲則穩賺 50 元了.

而當然從上例中, 看見乙其實也不是想買賣杯子的, 他衹是賺取丙的合約差價 50 元.

他也在到期前達到了穩賺 50 元

至於丙, 因為用100 元買入這權利, 再用 500 元轉手給丁, 於是他也穩賺了 400 元

關鍵就來了, 丁幹嗎用 500 元去訂這種合約呢 ?

原來更大的內情還在後頭.....(待續)

**********

恆生指數期權攻略 第 一 篇 (續)

期權認識

丁是不是很笨 ? 丁是否白白付了 500 元.

不是, 丁一點不笨, 他還賺了大錢.

因為丁早在市埸的杯子價格處於 5 元時, 就不斷收集, 收集了的現貨可能比甲還多. (也可以相反是從高價一直沽貨)

以丁現時持貨的數量來看, 他知道一下子推到市場上, 肯定影響杯子價格下跌.

這祇是很簡單的供求關係價格波動, 在此不細述.

於是丁明知道一旦大量杯子推出市場, 會令價格下跌.

他便在未推出現貨時, 先在市場尋求願意接手的買家 (或賣家)

以合約形式去訂明期限內, 用固定價格成交.

那為甚麼丁又不直接找甲用 50 元購入這行使權利, 卻又願多付 450 元去買入行使權呢 ?

試想, 甲一年祇可生產 10,000 杯子, 而市場可消化大約 8,000 至 9,000 杯子,

而丁卻囤積了 10 萬杯子.

丁這些杯子是他過去慢慢從市場中收集的, 平均價在 7 元之間.

而現時市價是 10 元, 當然他推出一百只或二百只, 是不太影響市價的.

但要一下子套現的話, 市場定必消化不來, 而令價格下跌.

所以丁在決定套現時, 就更不能將銷貨行動外洩. 特別是甲.

於是丁隨了用第三者身份向甲買入行使權利之外,

亦同時在期權市場中向乙, 丙等以高價搶入這些行使權.

務求在甲未察覺異動之前, 取得足夠行使權合約.

如果事前讓甲知道了, 豈不獅子開口 ?

好吧, 簽一個 10 元 買/賣 1,000 杯子的行使權, 5,000 元一張

因為風險太大了.

這樣丁就無利可圖了.

**********

從以上我們大概知道了期權市場有那些人物, 及期權市場的作用.

現在讓我整理一下, 把那些代入人物表達出來.

甲: 就是期權市場的莊家.

要達到期貨交易所指定條件的, 才可出任期權莊家.

包括必需定時報價.

而任何投資者亦可扮演莊家角式, 衹要每一張合約有足夠按金.

並得隨時在市況波動時補倉, 增加按金.

而風險理論上是無限大的. (沽出認購)

而沽出認沽則最大損失是所有價下跌至 0

莊家的最大利潤衹限於所收取的期權金.

乙, 丙, 丁 : 都是期權參與買賣者

期權參與買賣者, 假如購入的是認購期權, 利潤理論上是無限大的.

而購入認沽期權則最大利潤是所有價下跌至 0

不論購入的是認購或認沽期權, 最大損失是所有期權金.

杯子: 等同股票, 指數, 也可以是任何商品.

**********

恆生指數期權攻略 第 二 篇

為何要認識期權 ?

一般有買賣股票的都知道, 買入一隻股票. 要待價位上升後沽出才可獲利.

但有部份更精明的, 已懂得沽空股票獲利.

註: 沽空就是手上無物, 先借貨在市場沽出, 待價位下跌之後.

再於市場買入. 把股票歸還所借數量之後, 獲取差價.

但在股票沒有波動時, 即不升不跌. 則不能獲利了.

而期權則不同, 它的獲利方式可以如下:

1) 價格上升

2) 價格下跌

3) 不升不跌

同時期權高手的組合中, 更可細分為:

1) 先升後跌

2) 先跌後升

3) 狂升暴跌

不管你是從投資角度, 投機心態, 甚至視為賭博.

都是最公平的獲利工具.

衹有任你選擇方式的, 才稱得上公平.

然而有公平的投資工具, 卻不代表你穩賺不賠.

要在期權市場獲利, 同樣要對市場有所認識.

保持你的市場觸覺, 有自己的分析能力.

在未教大家如何分析市況前, 下一篇就會教大家如何買賣期權.

用甚麼方式及策略去買.

**************

恆生指數期權攻略 第 三 篇

如何買賣期權 ?

甚麼人可以買賣期權 ?

一般人都可買賣期權

買賣期權需要很大資金嗎 ?

不一定, 價外期權(註1)就低至幾百元即可買賣

註1: 價外期權是指跟現時市況的指數有差價或很大差價.

例如: 恆生指數現時是 20000 點

那麼同樣是 20000 點的認購或認沽期權, 就叫等價期權.

而低於 20000 點或更低的認購期權, 叫作價內認購期權.

高於 20000 點或更高的認購期權, 叫作價外認購期權.

相反,

低於 20000 點或更低的認沽期權, 叫作價外認沽期權.

高於 20000 點或更高的認沽期權, 叫作價內認沽期權.

跟現時指數相差很大的, 例如 30000 點, 或 10000 點的認購或認沽期權

統稱為極價外或極價內期權.

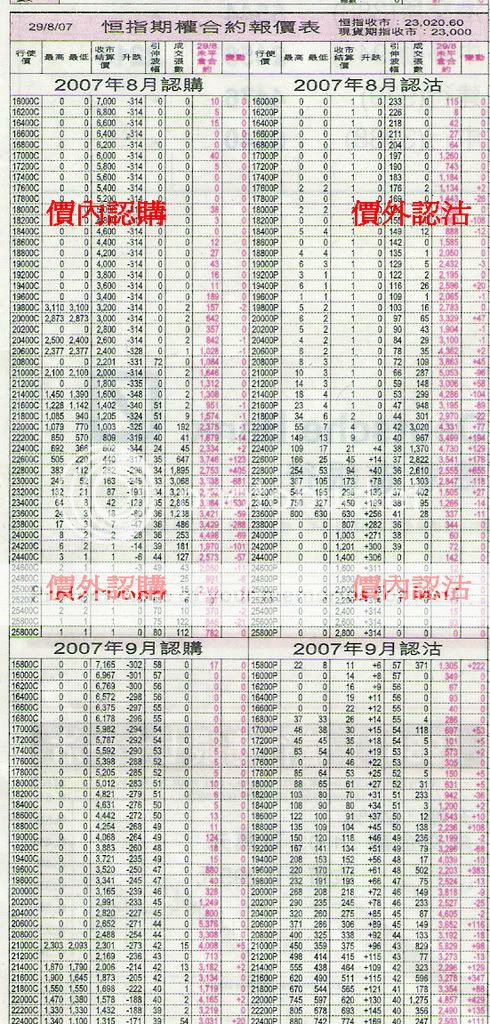

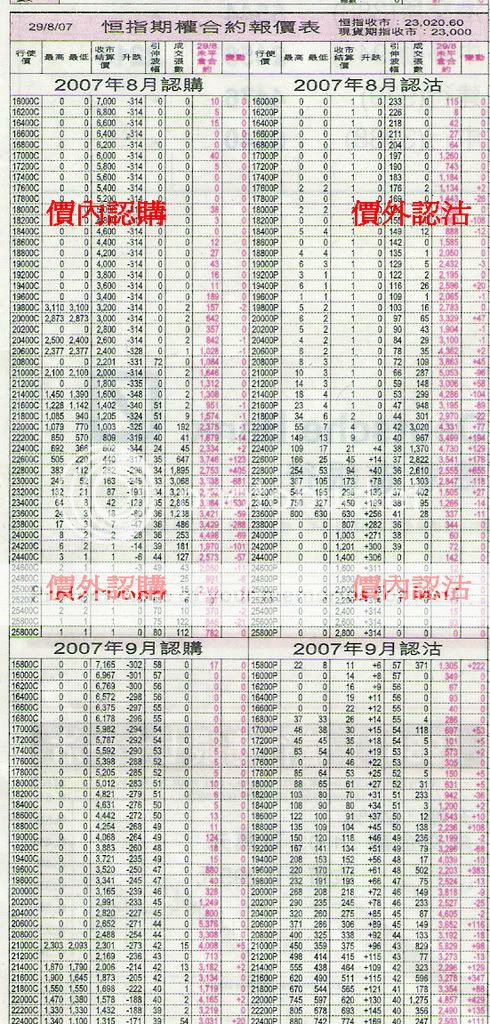

看下圖摘錄自 2007-08-30 經濟日報 投資版 期權報價

在那裡可買賣期權 ?

在期貨交易所指定的期貨經紀開設帳戶, 即可買賣.

買賣方式可用電話, 或網上交易系統.

如何得知期權報價 ?

期權不像股票普及, 所以各類報章的投資版, 較少篇幅報道.

而較為詳盡的, 要算經濟日報的投資版.

但要得知最詳盡的報價, 及即市現況最新報價.

則必需透過股市大利市的期貨交易報價系統.

或以電話向你的期貨經紀查詢.

亦可在香港交易所查看每日市場報告 (只有英文版)

香港交易所

http://www.hkex.com.hk/data/derivativesmarket_c.htm

每日市場報告

HANG SENG INDEX OPTIONS DAILY MARKET REPORT

http://www.hkex.com.hk/futures/futuresdayrpt/hsio070831.htm

如何認識報價 ?

買賣期權分 4 種方式, 分別是:

1) 買入認購 Buy call

就是看市況上升, 付出期權金. 利潤無限. 最大虧損僅限於期權金

2) 買入認沽 Buy put

就是看市況下跌, 付出期權金. 利潤最大為所有下跌幅度. 最大虧損僅限於期權金

3) 沽出認購 Sell call

等同莊家, 同樣是看市況下跌, 收取期權金. 利潤最大為收取的期權金. 最大虧損無限.

4) 沽出認沽 Sell put

等同莊家, 同樣是看市況上升, 收取期權金. 利潤最大為收取的期權金. 最大虧損所有下跌幅度.

期權莊家必需有足夠按金, 按金一般跟期貨指數按金相若. (大概每張合約 8~10 萬)

並得隨時在市況波動時, 按期交所指定補倉. (補倉即增加按金)

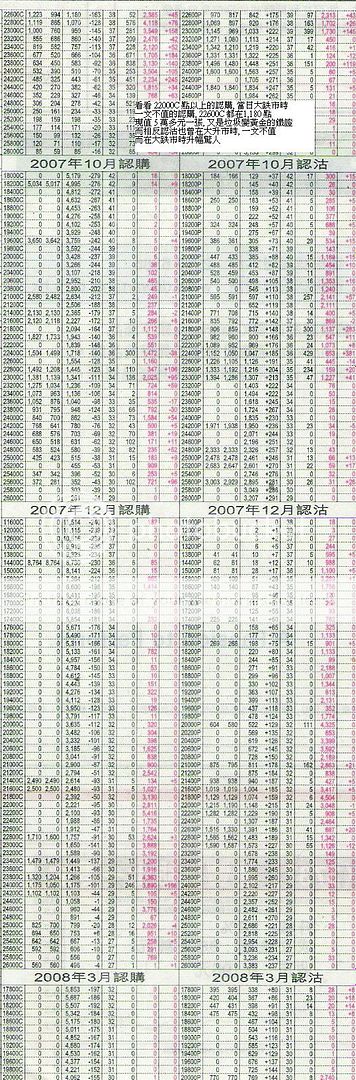

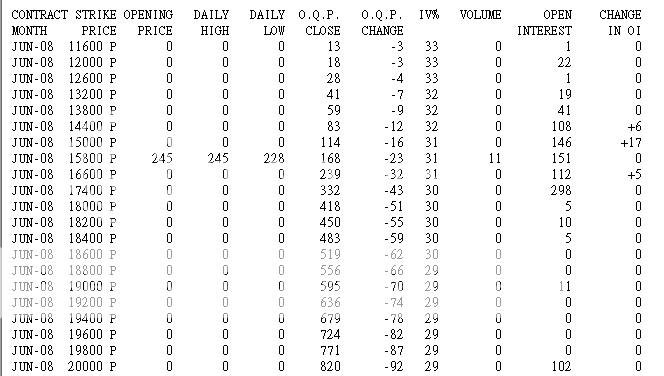

打開下圖看看, 是否明白當中報價.

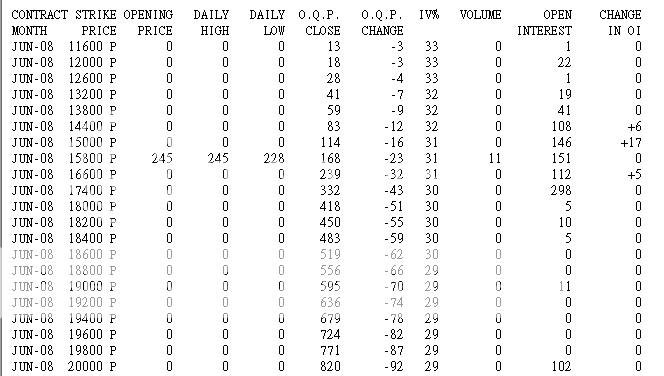

下圖紅圈, 2008年 6月. 11600 P 認沽, 價值 20 點(即1,000元)

因為這裡報價範圍有限, 但可推斷 11600 P 以下的, 則不值 20 點.

假如買入又如何獲利呢 ? 是否要等大市跌至 11600 點以下才獲利 ?

這些在下篇同樣再為大家說明.

而在期權市場中, 我們常聽到 - 時間值 及 引伸波幅

那又是甚麼呢 ? 在下一篇中, 你必需留心學習.

推薦參考期交所

恒指期權的常見問題

http://www.hkex.com.hk/invedu/invgallery/common_questions_c.htm

恆生指數期權攻略 第 四 篇

時間值 及 引伸波幅

這個大家必需認識, 這正正是我教大家一些本金不多的朋友,

利用時間值 及 引伸波幅 可以參與的重要環節.

時間值 - 就是時間的價值

一個期權合約是有到期結算的一天.

我舉個例子:

現時恆生指數是 20000 點, 假如你看好買入一個價外期權.

行使價是 28000 點, 價值 10 點 (500元)

但你買入的是現貨月 (即月)

而時間衹剩下 5 天便結算.

那麼你試想一下, 在 5 天時間內, 升上 28000 點, 即是要升 8000 點.

有可能嗎 ?

當然可能性就很低, 所以這個期權的價值, 就會隨著時間消失.

而令到可能性越來越低, 它的價值於是消失得很快. 甚至一文不值了.

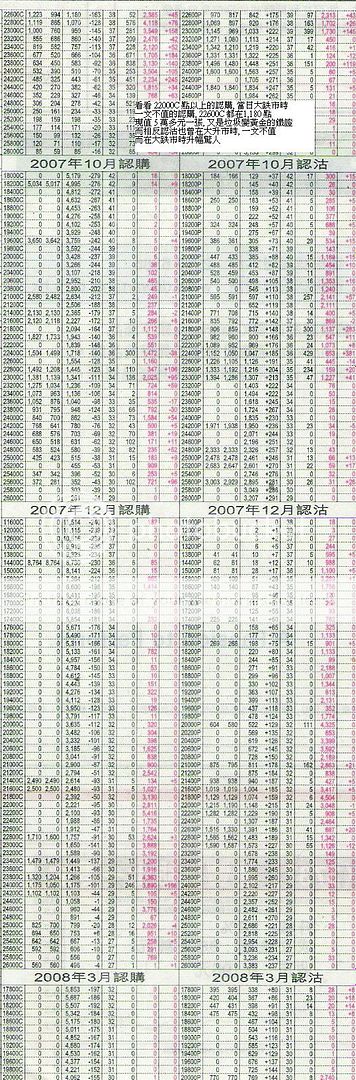

又假設買入一個更遠期的價外期權. (看下表 2008-06 月認沽, 這是真實報價 期交所 2007-08-31)

11600 P 價外認沽期權, 價值 13 點 (650 元)

現時恆生指數是 23000 點, 相差 11400 點.

但時間卻有差不多 10 個月

那麼你又再試想一下, 未來 10 個月內, 恆生指數會不會衹升不跌 ?

就算衹升不跌, 但仍不可抹煞下跌的可能, 因為仍有 10 個月的時間.

很多不可預料的事都會發生. 所以它的價值仍然存在.

這就是時間值 - 時間的價值

當然在實際買賣中, 買入 11600 P 價外認沽期權, 就不一定是看未來恆生指數會下跌至 11600 或以下.

因為衹要從 23000 點跌至 20000 點, 那麼這個距離, 就跟 11600 相近了一點.

而它的價值也因此而上升.

在它的價值上升時, 也可以隨時把它沽出獲利, 而不必等到 2008-06 月到期日.

至於 引伸波幅, 就是從大市的波幅引伸出來的影響, 就叫 - 引伸波幅

它有甚麼作用呢 ?

試想, 你買入了一個期權合約, 不論是看升或看跌.

假如大市天天不升不跌, 又或衹是輕微上升和下跌.

那麼對於一個價外期權來說, 是最不利的.

因為沒有大波動, 距離目標行使價就遙不可及.

期權金的價值也因此而降低.

但另一方面看, 卻是購入期權部署的最佳時機.

*************

下一篇預告:

不必推測短期大市走向, 大市升跌皆可獲利.

*************

恆生指數期權攻略 第 五 篇

不必推測短期大市走向, 大市升跌皆可獲利.

如果在賭場, 大家同時下注在 大 和 小

那真的自尋煩惱, 有輸沒贏.

都不用多解釋吧. 開個圍骰便賠清光.

而最重要的一點是: 一賠一

換然之不論開大或開小, 你所贏取的一注, 衹能成和局.

但在期權市場裡, 卻不盡相同.

因為它獲利的情況不同, 一可博無限.

舉例:

恆生指數在 20000 點 , 不推測其走向, 但推測未來市況極為波動.

那麼買入一個遠期極價外認沽期權價 及 一個遠期極價外認購期權.

價外認沽期權假設行使價是 10000 點 價值 10 點子 = 500 元

價外認購期權假設行使價是 30000 點 價值 10 點子 = 500 元

好了, 假設恆生指數在這一年都不升不跌, 那麼到期時, 就輸光 1,000 元

但我跟你說, 恆生指數在這一年都不升不跌, 有這可能嗎 ?

也是有的, 牛皮市. 就是一天升, 一天跌. 極之沉悶.

但這樣的牛皮市多見嗎 ?

那就關乎到技術分析及基本分析了. 這是後話, 後文再續.

但如果當時是波動市況;

或者正確一點說, 就是有足夠分析是處於波動市況.

才會進行這個策略性組合.

衹要恆生指數在這一年之內, 任何時候. 升跌幅超過 5000 點的話.

結果就是一個期權不斷升值,

但另一個期權會跌價, 但未必全跌.

因它仍有時間價值存在. 除非已接近到期日, 時間價值已消失.

上面的例子, 是完全真實例子.

一個本來衹值 500 元的價外期權, 因為恆生指數不斷上升, 或大幅下跌.

而令到本來極價外的期權, 變為價外或甚至等價期權.

其內在價值也因此從 10 點子升至幾百甚至1000 點過外

要知道 1000 點就是 50,000 元了.

但我提醒各位, 賺錢還沒那麼快.

期權的組合可謂千變萬化.

在高手的組合裡, 它可以買入價內認購, 沽出價外認購去降低成本.

亦等同不用付出十萬八萬按金. 因期交所接受對沖方式買賣.

這裡恐大家混亂了, 再溫習一下.

沽出認購或認沽期權, 是等同莊家.

不同於買入認購或認沽期權的, 不要搞混了.

*************

下一篇大家就要認識一下甚麼是對沖和套戥了.

你又知不知道, 套戥幾乎接近 100% 必賺不賠的呢 ?

恆生指數期權攻略 第 六 篇

對沖和套戥

在投資市場, 我們經常聽到這兩句術語.

到底有甚麼作用 ? 以及對投資者有何啟示性.

那就要認識一下了.

對沖又分同市對沖 (Hedging)

或跨市對沖 (Straddle)

同市對沖是指在相同市場內, 做出一買一賣的動作.

而這個動作, 主要是以降低風險為主, 利潤為次.

舉例:

一個期權莊家, 沽出了一個 9 月份以 25000C 點行使價的認購期權

收取了期權金 500 點 (25,000元)

而現時恆生指數為 24000 點.

假如恆生指數到月尾時, 低於 25000 點或 25000 點收市結算.

那麼這個莊家將可賺取全數 500 點期權金.

但如果恆生指數收市結算點數為 25100 點

那麼這個莊家將可賺取全數 400 點期權金.

但如果恆生指數收市結算點數為 25500 點

那麼這個莊家將無利可圖.

因為購入 25000C 點行使價的認購期權者,

其持有的行使價是 25000 點

換言之, 恆生指數收市結算點祇要高於 25000 點

就是行使者所收取的利潤

相反就是莊家的損失.

從上例看到, 恆生指數收市結算點數為 25500 點時

則雙方成和

高於 25500 點, 是認購者的利潤, 也就是莊家的損失

當大市非常波動時, 莊家亦會考慮到風險非常高.

因為一旦指數升上 28000 , 29000, 甚至 30000

莊家的損失便很高了.

莊家所沽出的這個認購期權, 收取了 500 點期權金

在 25500 點是打和, 25500 點以上, 是無限風險.

而又正值大市非常波動, 那麼這個莊家, 就會做出對沖這個行動去降低風險.

如何做法呢 ?

是不是把這個 25000 點行使價的認購期權, 轉而其他莊家呢 ?

當然可以, 這個莊家是可把沽出了的這個期權, 在市場買回相同行使價的認購期權的.

但如此一來, 豈不成了白做, 因為一買一賣也要付出相關費用. (雖然很低)

這個莊家當然不會這樣處理, 這個時候, 他就運用 同市對沖 (Hedging) 了.

怎樣運用法 ?

首先, 要留意上例子裡, 莊家的虧損點是 25500 點以上時, 才會損失.

於是, 他就在期權相同市場, 相同月份.

買入另一個不同行使價的認購期權.

不錯, 他可以買入更高行使價的認購期權

買入行使價 25500c 認購期權

由於 25500c 比他沽出的 25000c 認購期權較為價外

所以這個認購期權的期權金以當時計, 也一定不用 500 點

他可能用 400 點已可購得.

我們現在再計算一下, 恆生指數收市結算點數衹有 3 個結局

1) 不升不跌

2) 跌

3) 升

結局 1

當恆生指數收市結算點數為 25000 點 不升不跌

這位莊家手上沽出及買入的期權同時失去了行使價值

那麼這位莊家收取了 500 點期權金

付出了 400 點期權金

500 - 400 = 100 x 50 元 = 賺 5,000 元 (1張計)

結局 2

當恆生指數收市結算點數為 25000 點以下 跌

這位莊家手上沽出及買入的期權同時失去了行使價值

那麼這位莊家收取了 500 點期權金

付出了 400 點期權金

500 - 400 = 100 x 50 元 = 賺 5,000 元 (1張計)

結局 3

這位莊家手上沽出的認購期權, 要按當時上升指數, 25000 點以上

升了多少賠多少.

但他把風險轉嫁了, 連同收取了的 500 點, 他本該在 25500 點超越時賠上點數價值的

但他買入的期權行使價為 25500 點, 換言之, 在 25500 點以上, 他不必賠了

這是他付出 400 點的對沖價值換回來的.

當恆生指數收市結算點數為 25000 點以上 升

那麼這位莊家收取了 500 點期權金

付出了 400 點期權金

500 - 400 = 100 x 50 元 = 賺 5,000 元 (1張計)

看到了這 3 個結局, 得出一個答案.

這個莊家自己不冒這個風險, 但利潤少了.

而風險亦降低了.

這就是同市對沖的作用

至於跨市對沖 (Straddle)

則由於是牽涉不同市場, 所以又叫跨市對沖

如何跨市對沖法 ?

舉例:

一個期權莊家, 沽出了一個 9 月份以 25000C 點行使價的認購期權

收取了期權金 500 點 (25,000元)

而現時恆生指數為 24000 點.

那麼他祇需做以下動作.

(如同同市對沖例子, 莊家的損失點, 打和點, 及利潤點請參考上述同文.)

立即進入期貨市埸.

注意: 是期貨市埸, 不是期權市場. (進行誇市實例)

現時恆生指數為 24000 點.

9 月期貨指數不計高低水 24000 點

(註一: 高低水另文再述)

那麼這個莊家會留意著指數的去向, 他不必去推測後市.

因為祇有 3 個結局.

1) 不升不跌

2) 跌

3) 升

指數 不升不跌 他不必理會, 等著沒收期權金

指數 跌 他更不必理會, 等著沒收期權金

指數 升 這可要理會一下了, 但他不會太焦急.

因為他沽出的行使認購是 25000 點, 加上 500 點期權金

25500 點以上才虧損.

所以他注意著, 祇有當指數迫近 25500 點時

立即買入跟手上期權同月份的期貨指數一張.

這個動作是抵銷了上升所要賠出的點數.

但當回落時, 則要及時平倉. (這個動作風險極高)

這裡祇是讓大家先有了一個概念.

而接下來, 就再認識一下何謂套戥 (Arbitrage)

套戥雖然幾乎是穩賺不賠, 但都是機構性投資者的動作.

因為需動用的資金成本較大.

但投資者也要有所認識, 可知進退趨避.

先用一個簡單例子:

我們在國內用 100 港元可兌 96.8 人民幣

而在香港找換店用 100 港元可兌 97 人民幣

假如你在國內, 認識一些需要港元的商家.

那麼你就會在香港先用 100 港元兌 97 人民幣

再回到國內用96.8 人民幣 兌 100 港元

這樣子就賺取了 0,2 元差價了.

而你這個動作, 就是在進行套戥.

進入不同的市場, 套取差價, 就叫套戥.

那麼我們看看在金融市場, 又是如何進行套戥.

由於港元與美元掛鉤. 這就造成套戥的好例子.

就以金市來說, 香港的九九金成盤時, 是以國際金價為依歸.

而金價是國際性因素決定的, 不是香港單方面的買賣所能影響.

但九九金在香港是用港元報價, 而外圍金價卻是美元報價.

在時間上就未必能一致, 香港金價折合美元時,

就會比外圍金價上下差了幾港元.

而投資者就有機可乘, 沽出港金買入外圍金. (或相反)

同時進行, 賺取這個因地域性或時間性的價差.

再舉另一套息例子:

例如香港某些因素, 令到利率高於美元.

投資者就可沽美元, 揸港元套取較大息口.

因為有聯繫匯率制度, 匯率並無風險.

但必賺利息.

相同原理, 港息高於美元, 炒金的亦可沽空港金.

買入本地倫敦金, 收取較大港息, 付出較低息口.

這樣就可套息獲利.

好吧, 我們返回股票市場.

前文不是提及期貨指數高水和低水嗎 ?

高水和低水又可稱升水 (Premium)或貼水(Discount).

首先來說一下甚麼是高水.

以期指為例, 高水是指現時期貨指數, 比現貨指數為高, 就叫高水.

例如:

恆生指數現時 25000 點, 而期貨指數 25200 點

比現貨高出了 200 點, 這 200 點就是高出現貨的點數.

而相反, 低於現貨就叫低水, 不管低多少.

好了, 明白沒有 ?

再來就是如何進行套戥了.

要知道買入期貨指數或沽出期貨指數,

假使你中途不平倉, 一直持有到結算日的話.

你手上的期指就會以恆生指數月尾之前的一個交易日.

以當天每 5 分鐘的平均價作基準來計算賺蝕.

即是你在 25000 買入的話, 超越此點數上升則賺, 反之則虧.

同理, 在 25000 沽出的話, 下跌低於此點數則賺, 反之則虧.

而再要知道的是, 甚麼影響恆生指數升跌.

就是成份股, 組成恆生指數的股份, 或稱藍籌股.

知道這些關係之後, 就懂得如何進行套戥了.

當升水時, 立即沽出期貨指數. 買入同等比成份股.

當結算時, 不管大市升跌及任何結局.

結果是穩賺這高出來的點數.

低水則反過來做. 結果亦一樣.

雖然是認識了, 但由於涉及資金不少, 非散戶所能參與.

但這訊息很重要, 對你在期權市場的參考性十分有用